Intelligent Insourcing in Insurance: The End of a Traditional Outsourcing Era

Insurance operations have relied on outsourcing for many years. Business Process Outsourcing (BPO) helped teams scale quickly and cut costs, making it a primary choice for many business strategies.

Today, outsourcing alone can’t support the needs of modern insurance teams. The future looks different. It is faster, wiser, and focused on keeping knowledge inside the company.

With more workload and AI in the picture, we can slowly see the outsourcing ship sailing away, as we enter a new era of Intelligent Insourcing in insurance.

The Evolution of Insurance BPO: How It Started VS Where It’s Going

Outsourcing has existed long before the term “outsourcing” was coined. Companies started outsourcing simple tasks in the 1960s.

Big manufacturers wanted others to handle payroll, support work, and data processing. Soon enough, almost every primary industry outsourced something.

By the 2000s, outsourcing was massive. Business Process Optimization (BPO) helped companies scale without hiring too many people. Insurance companies used it to manage back-office work, underwriting support, claims tasks, and more.

Today, at the end of 2025, the same strengths that made outsourcing great now slow insurers down.

If you’d like to know more about the future of insurance operations, click here to read our latest article, “Specialty Lines in 2030: Predictions for Underwriting, Distribution, and Tech”.

Traditional Outsourcing: The Old Foundation

Traditional outsourcing remains a significant factor in insurance operations. Skilled back-office teams provide carriers with reliable capacity, standardized processes, and the ability to scale quickly without the burden of constant hiring and training.

The only difference with the new model is that it doesn’t stop there. Traditional outsourcing serves as a foundation for everything that follows.

Most insurance companies that start with back-office support later expand into automation and AI.

Augmented Outsourcing: Humans + Automation

Augmented outsourcing emerged in insurance a few years ago and has improved the traditional outsourcing model. Instead of humans doing every repetitive task, AI takes over the tedious work.

People focus on the tricky parts, while AI takes over the repetitive work. Underwriters review the AI output, correct if needed, and the AI applies what it has learned in the following case scenario.

Underwriters still do what they were initially trained for: underwriting. Internal or external teams solve exceptions and use judgment where it matters. Intelligent insourcing now cuts errors, shortens turnarounds, and reduces manual work. Tasks that took hours now take minutes. Each review helps the system get smarter.

Augmented outsourcing is already here and delivering measurable results. The systems capture feedback, improve continuously, and increase straight-through processing over time. By combining automation with human validation, augmented outsourcing helps insurers reimagine operations without taking on risk.

AI-First Outsourcing: Intelligent Insourcing

AI-first outsourcing, AKA intelligent insourcing, is the next leap forward. Unlike traditional or augmented models, where people remain the core engine of execution, this approach reimagines the entire workflow with automation at the center and humans in supervisory roles.

In an AI-first model, intake, classification, extraction, and routing are handled by intelligent systems that operate 24/7 at scale. Confidence thresholds, business rules, and regulatory checks are built directly into the workflow.

Human teams then act as exception handlers and quality supervisors, validating edge cases, resolving anomalies, and feeding insights back into the system.

Insurance carriers, MGAs, and brokers can choose whether to outsource or insource their human supervisors. The best thing is that each time a human intervenes, the system learns, rules evolve, and the automation grows more accurate and resilient.

The continuity and learning that AI-first outsourcing provides are what fundamentally differentiate it. By positioning automation as the primary engine and people as the judgment layer, AI-first outsourcing delivers speed, intelligence, and resilience in one integrated model.

Why Insurers Need Intelligent Insourcing

Outsourcing delivered decades of value to insurers, but the dynamics that once made it so powerful are now eroding.

Labor arbitrage is shrinking, repetitive roles no longer attract or retain talent, and valuable institutional knowledge often disappears into vendor teams.

What was once a source of cost savings and scale has become a ceiling on innovation. To understand why the old model has reached the end of its era, we need to examine the three biggest cracks in its foundation: the talent pool, the cost of human labor, and the knowledge drain.

Talent Pool

In the traditional outsourcing model, back-office roles are often repetitive and transactional, with limited growth potential. Data entry, document indexing, and other repetitive tasks can lead to disengagement and high turnover.

For insurers, BPO turns into constant retraining, variable quality, and a loss of operational momentum. Burnout becomes inevitable when talented individuals are required to perform the same repetitive tasks day after day.

With intelligent insourcing, the teams are AI-augmented, meaning that automation handles repetitive tasks, allowing people to focus on higher-value work. The shift improves process outcomes and makes the work itself more engaging.

By removing the drudgery, we attract stronger talent, reduce burnout, and dramatically cut attrition. The result is a more stable, motivated workforce that grows in expertise over time, rather than cycling out just as they become effective.

Cost of Human Labor

For years, wage differentials across countries and continents have created substantial savings for insurers. Rising wages, inflation, and the hidden costs of high turnover and retraining have steadily eroded the labor arbitrage advantage.

We build automation directly into workflows, so savings don’t rely solely on human labor costs. Intelligent systems handle routine tasks, such as data entry and data extraction, without interruption.

Human talent can be internal or external, depending on your needs, and we only require humans for supervision and exceptional cases. The hybrid model reduces costs by paying lower labor rates and requiring less labor overall.

Knowledge Drain

One of the most damaging side effects of traditional outsourcing is the slow erosion of institutional knowledge. Over time, carriers lose touch with the nuances of their own operations, ultimately weakening their teams.

When outsourcing vendors handle all the critical workflows, such as claims processing and policy or endorsement issuance, the valuable insights gained from processing thousands of tasks rarely make their way back to the carrier.

The goal of intelligent insourcing is to build intelligent processing alongside our clients, rather than taking over specific tasks. Every workflow we support trains AI systems on client-specific data, creating models and rules that remain with the carrier as an enduring asset. they

Each example enhances the system’s intelligence, strengthens internal capabilities, and reduces reliance on external labor.

Intelligent Insourcing with Bound AI

Rising costs, burnout, and knowledge drain are only a few downsides of traditional outsourcing in 2025. The old model can’t keep up with today’s technology and insurance-tailored AI platforms.

With that being said, we’re pleased to present the new model of insurance outsourcing: Intelligent Insourcing with Bound AI.

The best thing is that Bound AI does the heavy lifting, but people still guide the critical steps. Our workflow learns daily, on each example and each input from your underwriting team.

Insurance-Specialized Tools

Bound AI reads insurance documents, such as accords, SOVs, and supplemental applications, and understands insurance language.

Ready to start your insurance ops transformation? Choose one of the following AI agents:

- Submission Triage Agent

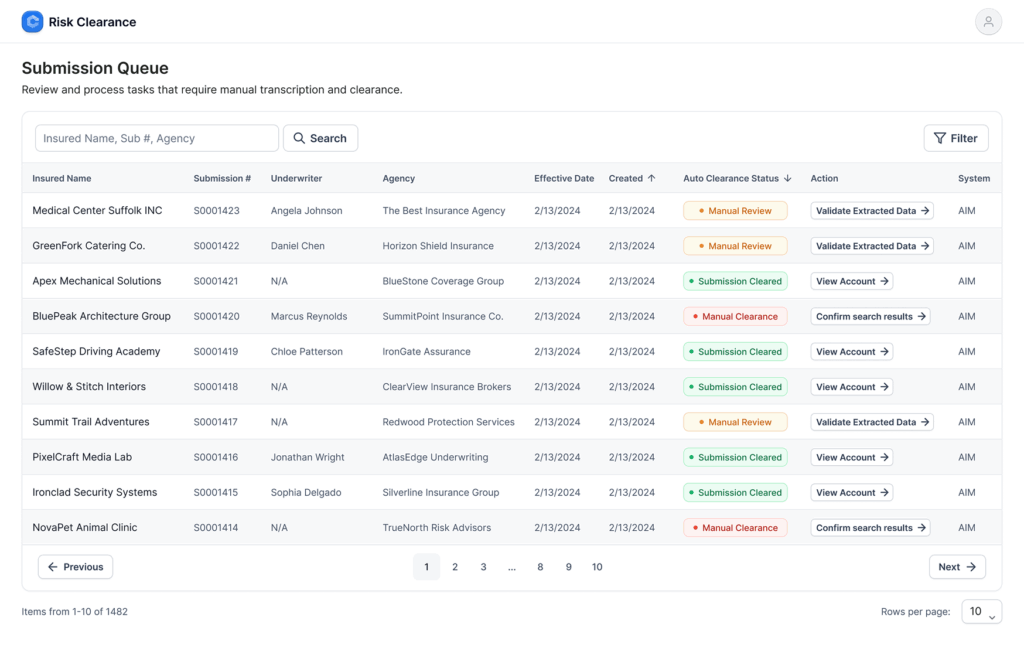

- RiskClear Digital Worker

- Loss Run Analysis Agent

- SOV Processing Agent

- Policy Checking Agent

The Bottom Line

Outsourcing has helped insurers for years, but its limits are now clear. Intelligent insourcing is the new path forward, combining automation with human judgment.

Why wouldn’t you build your workflows that learn and keep knowledge inside your company? The best advantage is that there are no downsides, while intelligent insourcing still makes your operations faster, smarter, and ready for tomorrow.

Intelligent insourcing is the model OIP Insurtech and Bound AI already deliver. If you want to prepare for the future, intelligent insourcing is where you start. Book a demo to begin your journey now.